.png)

We are committed to helping you protect your deposits, especially during times of market volatility.

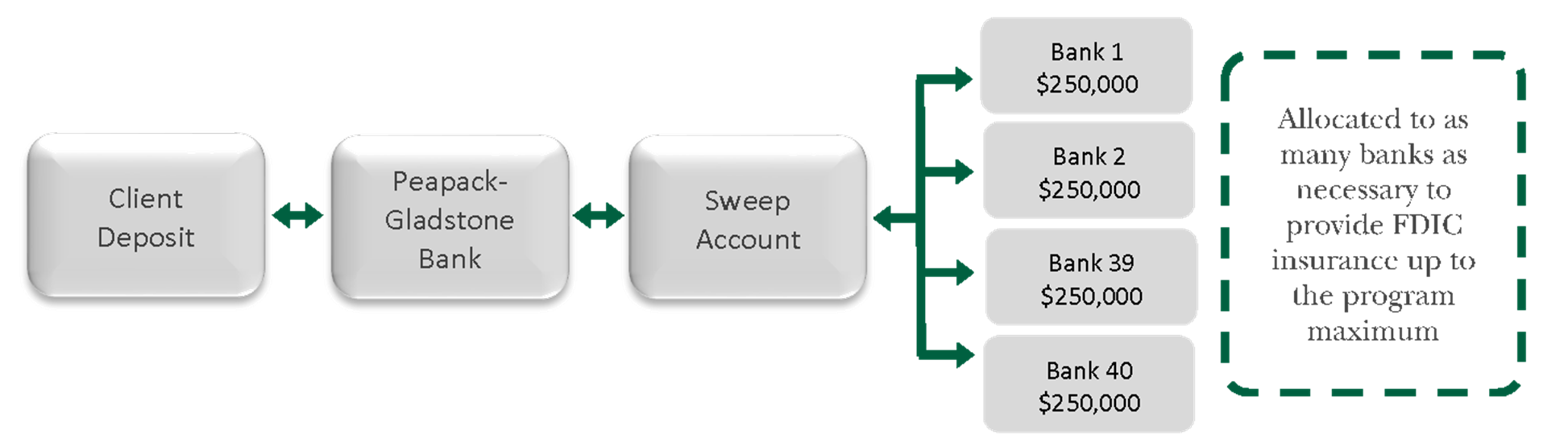

The PGB Insured Liquidity Sweep* program is one of the most flexible, multi-million-dollar FDIC insured cash management solutions available in the market. The PGB Insured Liquidity Sweep provides you with access to a network of US banks that, together, can offer millions of dollars in FDIC insurance coverage and daily liquidity. The PGB Insured Liquidity Sweep is an ideal cash sweep option for anyone seeking safety, security and liquidity.

Benefits:

- FDIC insurance reduces the risks associated with money fund investing

- Diversification of deposits among FDIC insured banks reduces overall exposure

- Millions in FDIC Insurance

- Cash is available daily

- Funds are always accessible with no penalties on the number of monthly withdrawals

- Avoid the burden of dealing with numerous bank relationships and benefit from a high level of FDIC insurance through a single contact point

How it works:

Client cash balances are sent daily into the PGB Insured Liquidity Sweep program and allocated into several program banks to ensure high levels of FDIC Insurance.

* Please carefully read the PGB Insured Liquidity Sweep program (“program”) Terms and Conditions before depositing any money into the program and for other important customer disclosures of information. The program itself, is NOT an FDIC-insured product. Rather, under the program, your funds are deposited into deposit accounts at participating banks or other financial institutions which are insured by the Federal Deposit Insurance Corporation (FDIC) for up to the current standard maximum deposit insurance amount (SMDIA) of $250,000 per eligible depositor, per receiving bank or institution, for each ownership capacity or category, including any other balances the depositor may hold directly or through other intermediaries, including broker-dealers. Please contact us to confirm the receiving institutions at which your deposits are held at any given time. If you hold any funds at a receiving bank or institution outside the program, when combined with your deposits held at that institution through the program, the total amount of your deposits at that receiving institution could exceed the SMDIA for an ownership capacity or category, and those excess funds will not be FDIC insured. The total amount of FDIC insurance available on your deposits under the program depends on the number of receiving institutions in the program. If the amount of your deposits in the program is greater than the maximum FDIC insurance coverage under the program, any excess funds will not be insured. To assure your FDIC coverage, please regularly review banks in which your funds have been deposited and notify us immediately if you do not want to allocate funds to a particular bank or banks. If you so exclude a bank from the program, the maximum level of FDIC insurance coverage available under the program may decrease. Please contact us for the maximum amount of FDIC insurance currently available on your deposits under the program.